crypto coins for ai Unlocking the Future of Technology

crypto coins for ai sets the stage for this enthralling narrative, offering readers a glimpse into a story that intertwines the realms of cryptocurrency and artificial intelligence. As technology advances, the integration of crypto coins into AI applications is not just a trend but a transformative shift that enhances development, deployment, and data security in AI systems. These specialized coins are designed to facilitate transactions, incentivize innovation, and bolster the capabilities of AI projects worldwide.

In this exploration, we will delve into the major players driving the AI crypto space, the real-world use cases that showcase their potential, and the promising investment opportunities on the horizon. Whether you’re a tech enthusiast or an investor, understanding these dynamic intersections will provide valuable insights into the future of both industries.

Overview of Crypto Coins for AI

The intersection of cryptocurrency and artificial intelligence (AI) has given rise to a new breed of digital currencies specifically designed to optimize and enhance AI applications. Crypto coins tailored for AI are created to facilitate decentralized systems that can improve the efficiency and effectiveness of AI technologies. These coins not only serve as mediums of exchange but also as tools that contribute to the development and deployment of AI solutions.Utilizing crypto coins in AI development offers numerous benefits, including increased transparency, enhanced security, and the ability to incentivize data sharing.

By leveraging blockchain technology, AI projects can ensure that data used in training algorithms is both secure and verifiable. There are several notable examples of crypto coins that focus on AI, such as SingularityNET (AGI), Numerai (NMR), and Cortex (CTXC), each playing a unique role in the AI landscape.

Major Players in the AI Crypto Space

In the rapidly evolving landscape of AI crypto, there are several key players making significant strides. Some of the leading crypto coins that focus on AI functionality include:

- SingularityNET (AGI): This platform allows anyone to create, share, and monetize AI services at scale. Its decentralized nature encourages collaboration among AI developers.

- Cortex (CTXC): Cortex enables AI models to be integrated directly onto the blockchain, allowing users to execute AI algorithms and even create smart contracts powered by AI.

- Numerai (NMR): Focused on data science, Numerai incentivizes data scientists to build models that predict financial markets, rewarding them with its native token.

When comparing market capitalizations, SingularityNET leads with a robust community and visionary roadmap, while Cortex and Numerai also exhibit strong growth potential fueled by innovation and strategic partnerships.

Use Cases for Crypto Coins in AI

The application of crypto coins in AI showcases their pivotal role in various real-world scenarios. These use cases highlight how crypto coins enhance AI capabilities and provide novel solutions to complex problems.

- Data Sharing and Integration: Crypto coins facilitate secure data exchange between entities, allowing for collaborative AI training on diverse datasets without compromising privacy.

- Decentralized AI Marketplaces: Platforms like SingularityNET allow developers to offer AI services and algorithms to consumers, creating an ecosystem of shared knowledge.

- Enhanced Security: By using blockchain, AI systems can secure sensitive data, thus improving user trust and compliance with data protection regulations.

The integration of blockchain technology with AI through crypto coins not only streamlines operations but also enhances data privacy and security for AI systems, fostering a more trustworthy environment for users.

Future Trends in AI and Crypto Coins

As AI continues to evolve, several trends are likely to shape the future of crypto coins within this space. The growing convergence of AI and cryptocurrency presents exciting opportunities and challenges.

- Increased Adoption of AI Solutions: As businesses seek innovative tools, the demand for AI-driven solutions supported by crypto coins is likely to rise.

- Emergence of New Crypto Coins: We may see the launch of specialized coins aimed at addressing unique AI challenges, particularly in areas like machine learning and data security.

- Regulatory Changes: Anticipated regulations could impact the development and deployment of AI-focused crypto coins, emphasizing compliance and ethical considerations.

The expansion of regulatory frameworks will play a crucial role in guiding the safe and responsible integration of AI and cryptocurrency.

Investment Opportunities in AI Crypto Coins

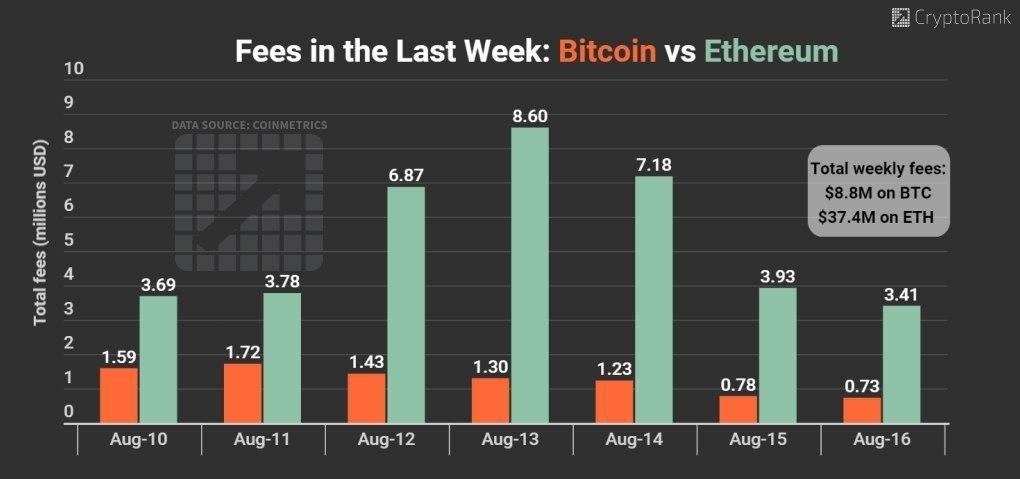

Investing in AI-focused crypto coins presents both opportunities and risks. Evaluating the potential of these coins requires a strategic approach.

- Market Analysis: Investors should assess market trends and the roadmap of each project to gauge its long-term viability.

- Risk Assessment: Like any emerging technology, the AI crypto market carries inherent risks, including volatility and regulatory uncertainties.

| Crypto Coin | ROI (Last 3 Years) | Market Cap |

|---|---|---|

| SingularityNET (AGI) | +150% | $300 Million |

| Cortex (CTXC) | +200% | $120 Million |

| Numerai (NMR) | +250% | $90 Million |

Investors should stay informed about potential fluctuations and the broader market sentiment that could influence these AI crypto coins.

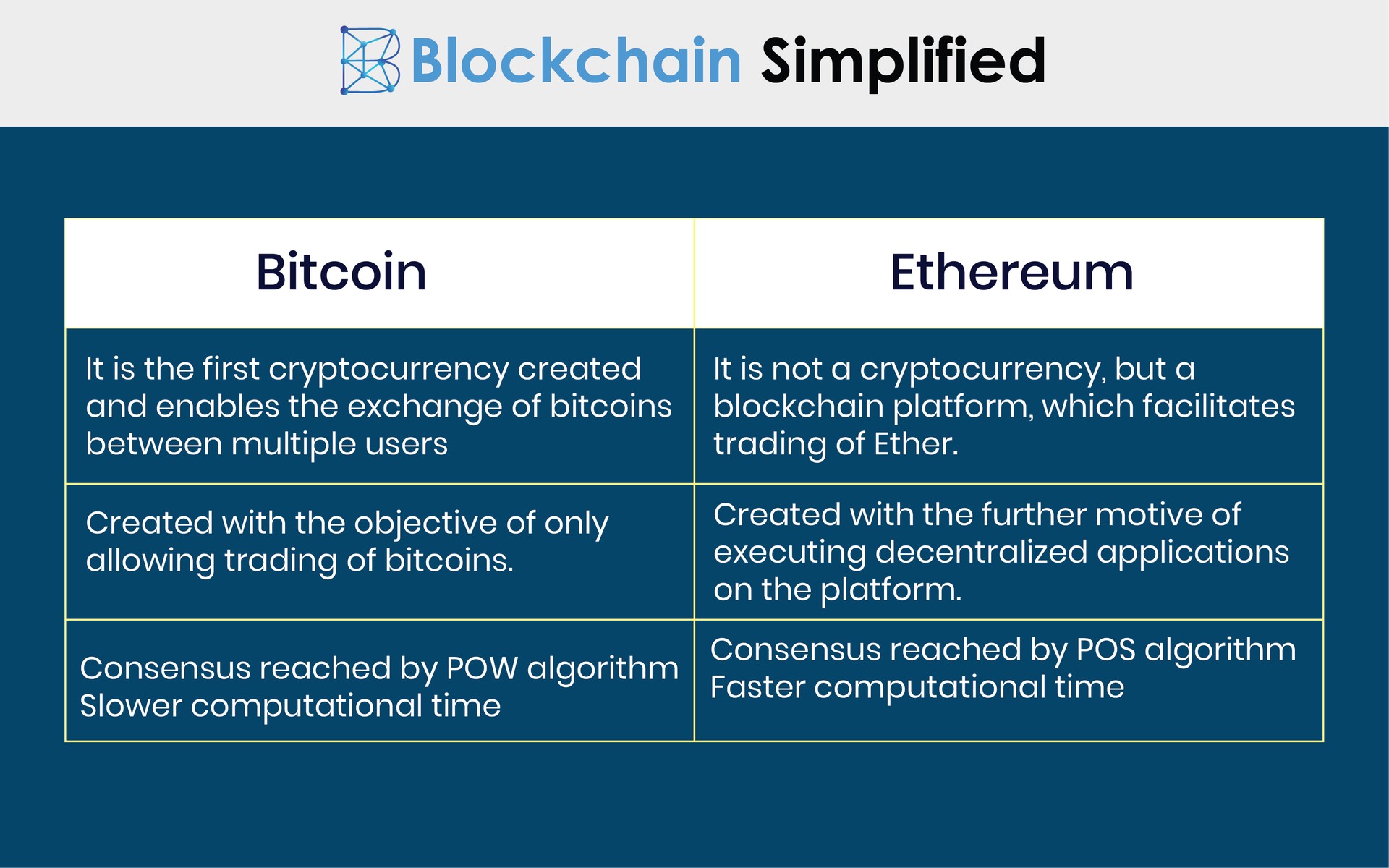

Technical Aspects of AI Crypto Coins

The technological foundation of AI crypto coins is essential for their functionality and effectiveness. Understanding these technical aspects is crucial for developers and investors alike.

- Blockchain Technology: Most AI crypto coins operate on blockchain networks that facilitate secure and transparent transactions, ensuring data integrity.

- Consensus Mechanisms: Various consensus mechanisms, such as Proof of Stake or Delegated Proof of Stake, are utilized by these coins, impacting their efficiency and scalability.

- Integration with AI Algorithms: Developers can integrate AI algorithms with crypto transactions, enhancing the capabilities of decentralized applications and smart contracts.

Harnessing the right technologies is vital for the success of AI-focused crypto projects as they seek to innovate and disrupt existing paradigms.

Community and Ecosystem Development

Strong community support is paramount for the sustainability of AI crypto projects. The ecosystem surrounding these coins can significantly influence their growth trajectory.

- Community Engagement: Active participation from developers, users, and investors fosters a vibrant ecosystem that drives innovation and adoption.

- Contribution Opportunities: Developers can contribute to AI coin ecosystems by creating applications, improving algorithms, or enhancing the user experience.

Resources and platforms that facilitate collaboration among developers include GitHub, various blockchain forums, and dedicated community channels, which are crucial for nurturing the growth of AI-focused crypto projects.

Challenges Facing AI Crypto Coins

Despite the promising potential of AI crypto coins, several challenges must be addressed for these projects to thrive.

- Technological Limitations: Current blockchain technologies may struggle with the scalability required to support high-demand AI applications.

- Scalability Issues: As user bases grow, maintaining transaction speeds and network efficiency can become increasingly challenging.

- Ethical Concerns: The intersection of AI and cryptocurrency raises ethical questions about data privacy, bias in algorithms, and the broader societal impacts of automation.

Addressing these challenges head-on is essential to ensure that AI crypto projects can reach their full potential while maintaining public trust and regulatory compliance.

Last Recap

In conclusion, the fusion of crypto coins and AI presents a remarkable frontier for technological advancement and investment. As we’ve discussed, these digital currencies not only empower AI initiatives but also introduce innovative solutions for privacy, scalability, and security challenges. The future holds exciting possibilities, and staying informed about emerging trends and projects will be crucial for anyone looking to navigate this evolving landscape.

FAQs

What are crypto coins for AI used for?

They are utilized to enhance the development and deployment of artificial intelligence applications, offering efficient transaction methods and incentivizing innovation.

How do crypto coins improve data privacy for AI?

By leveraging blockchain technology, they offer secure and transparent data handling, which helps in preserving user privacy and integrity of AI systems.

Are there any risks associated with investing in AI crypto coins?

Yes, like any investment, there are risks including market volatility, regulatory changes, and technological challenges specific to AI and cryptocurrency sectors.

Can AI enhance the functionality of crypto coins?

Absolutely! AI can optimize the transaction processes, improve security protocols, and enable smarter contract execution within crypto ecosystems.

What are the future trends for crypto coins in AI?

We can expect the emergence of new coins tailored for AI advancements, increased regulatory focus, and further integration of AI capabilities into existing crypto platforms.

![Cryptocurrency Course For Beginners in Singapore [2024] Cryptocurrency Course For Beginners in Singapore [2024]](https://awakeningthedreamer.icu/wp-content/uploads/2025/10/best-crypto-trading-course-david-l-bishop-david-s-lee.jpg)